DYN+

Discover How You Can Retire 5 Years Earlier - Easily and Effortlessly

Love the idea, but don’t know how? You probably think “Nah, it’s impossible” But these inner struggles keep showing up when you have time to sit down.

~I’m tired of working and chasing deadlines, when will I be able to stop working?

~ I hate my new boss, I don’t want to work anymore…..

~Last week, my colleague lost his job, when will it be my turn?

I feel you too. Once upon a time, I experienced what you are experiencing now.

That’s how I help Gina save 6 years of her life so she could ‘choose’ to retire at 49 instead of 55.

How?

Discover How You Can Retire 5 Years Earlier - Easily and Effortlessly By Doubling Your Wealth Within 7 years Even For Beginners

Hi! My name is Ka Hoe, and my mission is to help you get your financial breakthrough by developing healthy money habits and behaviours so you can live a happy and confident life

“How?” you may ask.

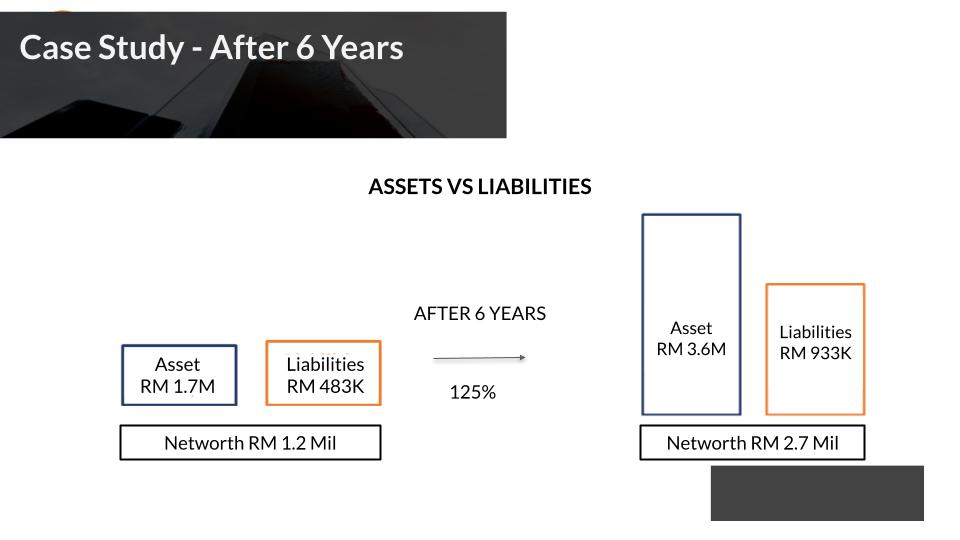

Here is a story of Gina… she doubled her wealth in 6 years

This is Gina, a 41-year-old IT manager from Maybank, and mother of two. She finds out she has a combined RM 2.7 Million networth (wealth) with her hubby during a review in 2024.

She couldn’t believe she had gotten this amazing result, considering they started from only RM 1.2 Million in 2018.

Why? Cause when she first started, she told me:

“I’m new to investing, I need step-by-step, and I have no extra time.”

You see, Gina and her husband are a very hardworking couple. They start the day as early as 7am, all the way to 11pm.

During that time, it includes

As a result, she has very little time for themselves, let alone manage their finances.

So How Did She Do It?

She used my 5-Step Double Your Networth framework.

What is Double Your Networth?

Double Your Networth is a Financial Planning process I developed to help individuals increase their assets, reduce their owings and free up their cashflow so they can double their wealth within 7 years.

Like Gina, she did not know where her finish line was (to retire).

Furthermore, she did not know where her starting line is (as in, where is she now in her financial situation).

So in this program, I guide Gina to find out

So that she could see her roadmap and decide what’s the best vehicle (investment vehicle) to get her to her destination, with risks she can tolerate.

“I did not expect to see the end of the road so quickly. I thought there is still a long way to go. But I’m happy to start exploring what is it I want to do now when I retire.” Gina in her own words

Still Sceptical? Let Me Elaborate

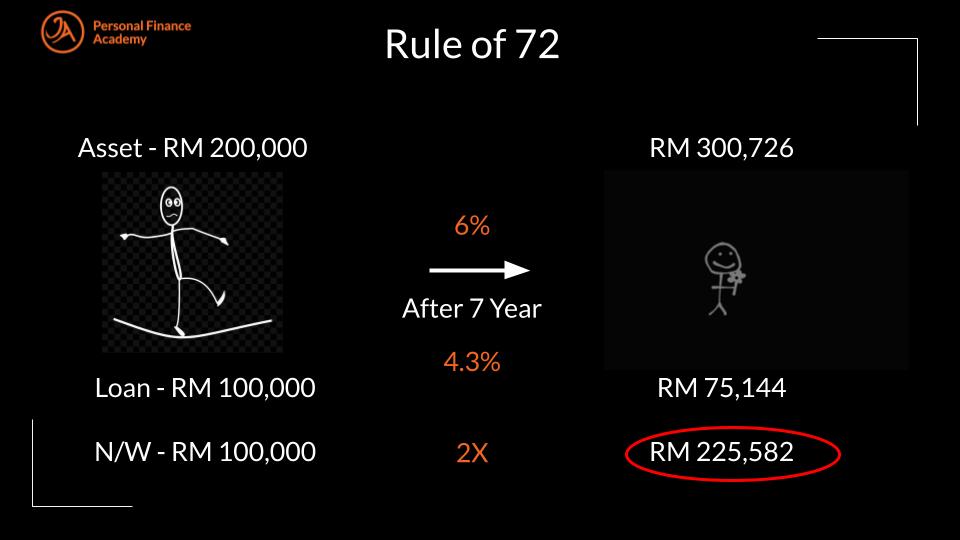

Have you heard of the Rule of 72? Yes? No?

Rule of 72 states that when you want to double your wealth, you just have to grow it at 10.3% a year consistently for 7 years to get the doubling effect.

You just have to increase your asset by 6% per year for 7 years.

And reduce your owings by 4.3% per year for 7 years.

That’s how you get 10.3% (6% + 4.3%)

Notice the Networth (which is your wealth, which is also your Asset - Loan) doubled from RM 100,000 to RM 225,582.

It’s not magic, it’s accounting.

Then why so many still can’t do it?

Cause you don’t have the tools, templates and know-how - just like how a pilot can fly on autopilot but you still need a pilot to ensure the plane stays on track using all his barometers in the flight dashboard.

Got it so far? So it is possible.

What is DYN+

DYN+ is every step you need to

Double Your Wealth within 7 years

So You Can Retire 5 Years Earlier

DYN+ is a program I designed which consists of all the courses and workshops you need to double your wealth. Let me walk you through how I designed it to help you take baby steps, stack them up monthly and get you your compounding results you are looking for

Phase 1 - Find out Your Starting Point (Financially)

Start with

Step 1: ICE JAR - the world’s simplest money management system

Find out how healthy your current cashflow and begin to put aside savings first before you start spending (we call it Pay Yourself First).

Step 2: Financial Compass

Find out what and where your current resources are by going through your Asset & Liability. That way, you understand how hard your money is working for you. This will be your starting point.

Step 3: 1-to-1 with Double Your Networth (DYN) Coach

Get insights from a DYN Coach on 3 significant perspectives.

3.1 What have you been doing right that you need to double down?

3.2 What are you doing wrong that you need to stop doing?

3.3 What are your top 3 burning questions that, when answered, will improve your financials significantly?

Phase 2 - Find Your Finish Line (Financial Freedom Number)

Next,

Step 4: Find out your Finish Line - Your Financial Freedom Number

Set your finish line, so that you know when you have crossed it. Rather than running around in circles, I will provide you the DYN Playbook with done-for-you calculations and optimization for your finish line so you feel motivated rather than overwhelmed.

Step 5: Check in monthly in our Double Your Networth (DYN) Monthly Mentorship - Live Webinar every 2nd Wednesday

Every month, I will be covering a different topic to set you up to Double Your Networth. Don’t worry, I know you are busy, so I provided playbacks for you. However, live webinars are still always better as every month we will be playing games and activities + a homework for you to stack up your actions to get the compounding results.

What Will We Be Covering Monthly? (this may change & get updated as the group improves)

| January | - What's Your Financial Freedom Number? |

| February | - Elevate Your Financial IQ thru ICE |

| March | - Have to save 50% of your tax payment? |

| April | - Are You Healthy Financially? From your Asset & Owing |

| May | - What's The Best Investment Out There? |

| June | - Reduce Your Premium 3x and 5x Your Coverage |

| July | - Get 5 - 23% Return in 4 Months Using HGS |

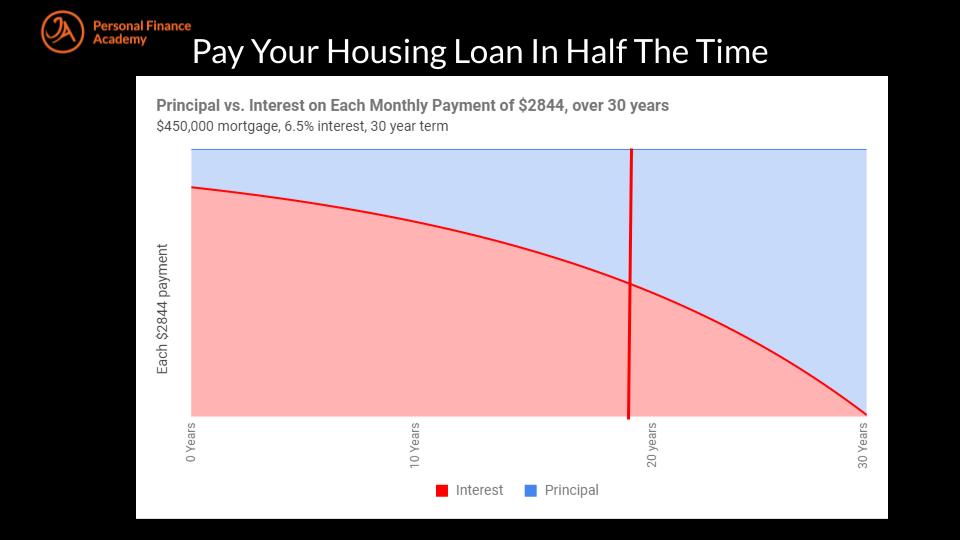

| August | - How To Pay Off Your Housing Loan in Half The Time? |

| September | - How To Invest 80% of Your Assets at 8% Per Year? |

| October | - Have You Started Doubling Your Wealth? |

| November | - What's the best performing Unit Trust?" |

| December | - Are You On Track To Double Your Networth? |

Step 6: Repeat - Once you set it up for 1 year, you can monitor and ensure your habits and behaviours contribute towards your Doubling Wealth effort in Years 2 - 7.

So, What Will You Be Learning In Double Your Networth?

After all is said and done, you are probably still wondering what are the core modules and pillars, right?. Let me break it down for you the 5-Step Double Your Networth (DYN) Framework - MOFIC.

A) Maximize (M)

1) How to 5x your insurance coverage (your emergency funds) and reduce 3x your premiums?: Learn to maximize your insurance policies by using my Policy Maximization Rate (PMR) framework. That way you can free-up cashflow and maximize your coverage according to your needs.

B) Optimize (O)

2) Pay Less Interest Than Ever Before: Learn to pay 50% less interest so that you can pay off your housing loan in half the time. This is where you can reduce your owings by 4.3% yearly by using the Interest Optimization strategy.

C) Free Up Cashflow (F)

3) How To Free-Up RM 2k/mth Without Cutting Necessary Expenses: Learn to identify where you are overspending, over-committing or over-investing so you can make the necessary adjustments and free up to RM 2,000 per month.

D) Invest (i)

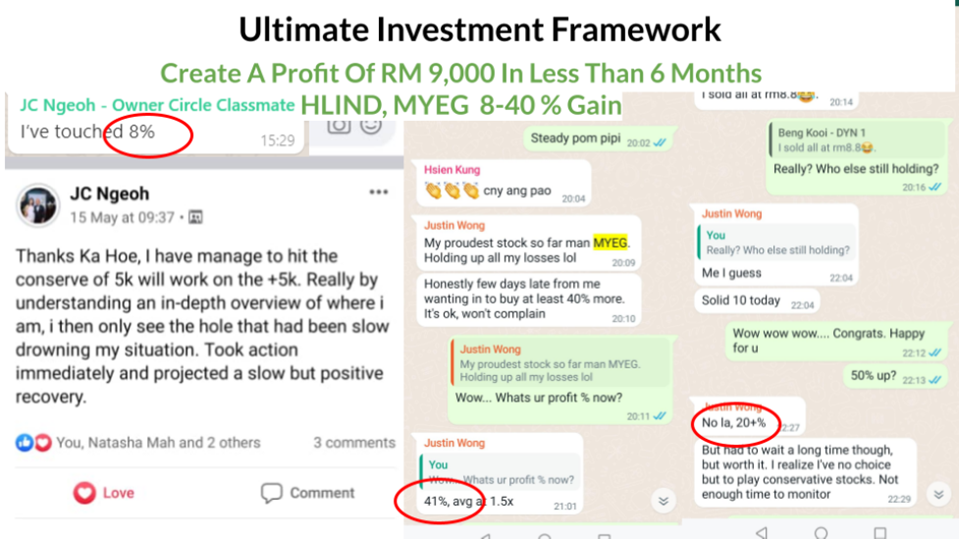

4) How To Get 6% Return Per Year Minimum? Learn The Ultimate Investor Framework so that you are able to pick up G.O.O.D assets regardless of what deals you are presented moving forward. You will be able to tell what is the underlying asset you are investing in.

5) How To Generate 5-23% Return in 4 months: Learn our advanced Hidden GEM System so that you will be able to spot G.O.O.D assets at below-market value prices using value investing without doing the hard lifting of screening 900 stocks in Bursa Malaysia.

E) Compound (C)

6) How to Invest 80% Of Your Assets at 8% Per Year: Compound your return by understanding what return you are getting now, so you can take a low-risk and high return for 80% of your assets to work for you

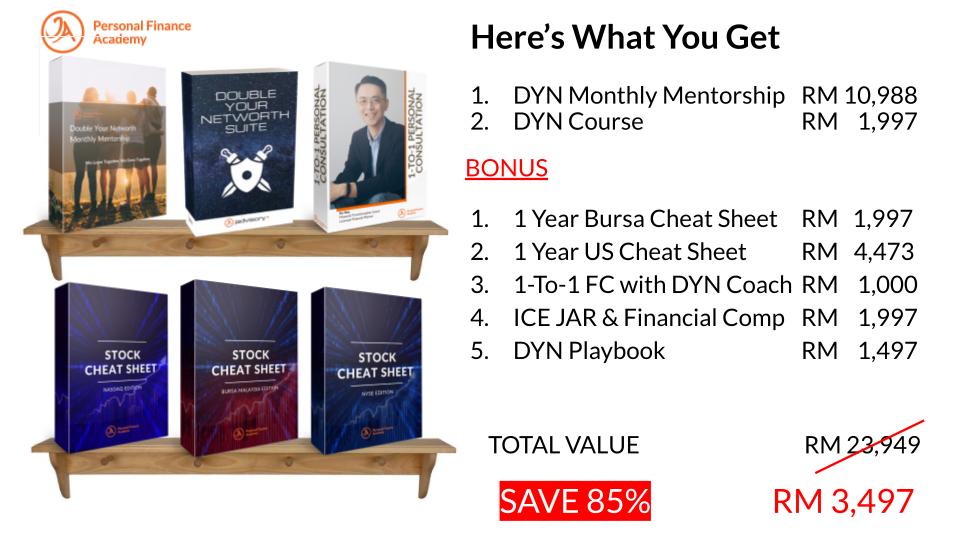

Want Your Bonuses?

1) DYN Course - Step-by-step bite-sized course recorded for you to learn at your own pace and space. (Value at RM 1,997)

2) 1 Year Bursa Cheat Sheet - On top of that you will get the Bursa Cheat Sheet so you can save time without having to go through 900+ companies in Bursa Malaysia to find your Undervalued + Profitable Stock to work your money 2x harder. (Value at RM 1,997)

3) 1 Year U.S Cheat Sheet - Plus due to popular demand you will get the NASDAQ & NYSE Cheat Sheet so you can save time without having to go through 4000+ companies in U.S to find your Undervalued + Profitable Stock to work your money 2x harder. (Value at RM 4,473)

4) Financial Compass 1-to-1 Consultation with DYN Coach - 60 Minutes private & exclusive session to discuss your financial situation with a DYN Coach. To identify the challenges and develop the strategies to create your money breakthrough results. (Value at RM 1,000)

5) Financial Compass e-Course - Find out where you are financially and how hard is your money working for you. (Value at RM 497)

6) DYN Playbook - While you are going through your DYN course and DYN Monthly Mentorship, you have a personalized handbook with 25+ 'done-for-you' templates to guide you towards your financial freedom journey. This will save you time and focus on getting your breakthrough results. (Value at RM 1,497)

Be an early bird & lock in your seats at early bird prices. At JA, we believe in “the early bird gets the worm.”

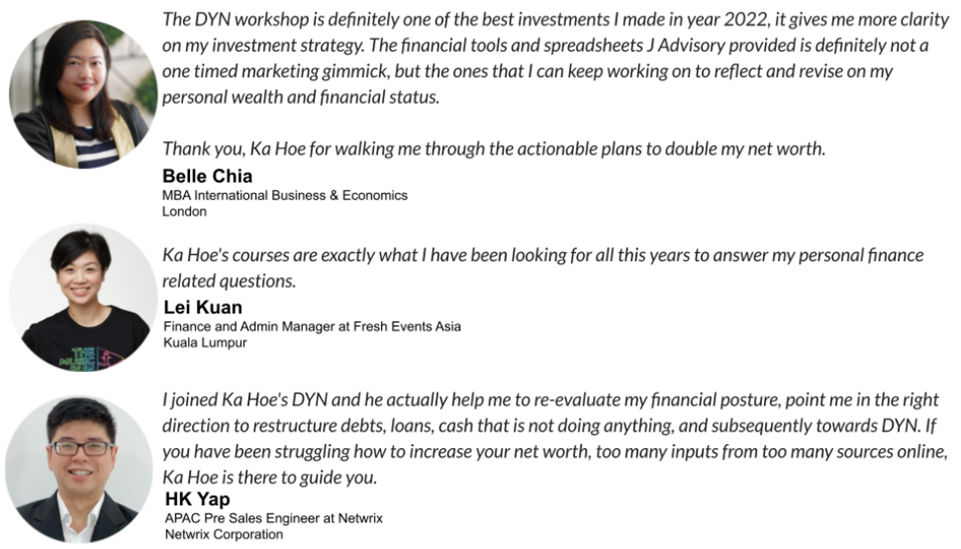

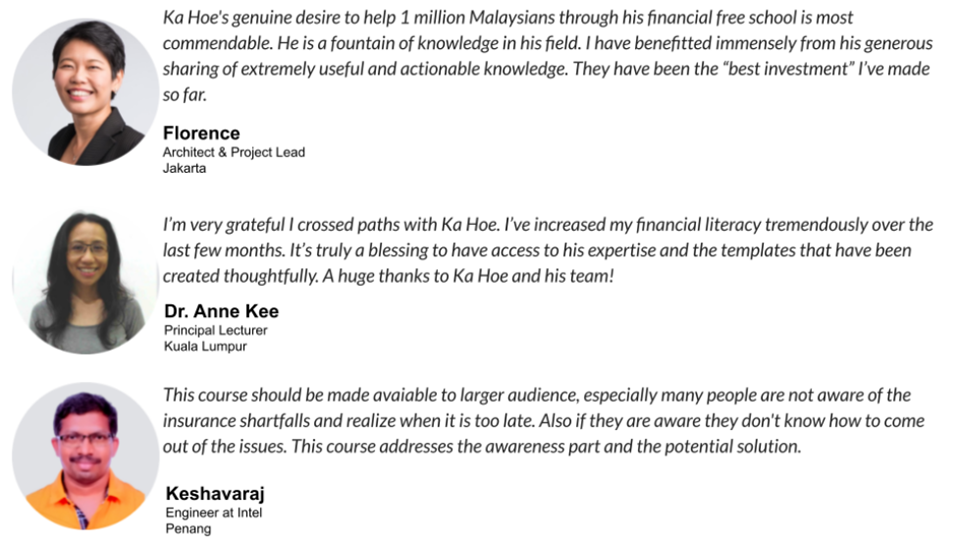

What Others Say

Is This For You? Are you

In short, you are someone who feels you deserve better than your current circumstances and is willing to do something about it!

Money Back Guarantee

A risk-free offer for you- a 30-day money-back guarantee if there is not ONE thing you learned from attending this course.

It's simple: Join the program and go through the DYN+ Bundle (Double Your Networth). If there's not 1 thing you learn from the powerful tools, systems and strategies in DYN+ Bundle, I want you to email me. Show me you did the exercises in Step 1 -3 and I'll give you all your money back (including the merchant fee).

So what are you waiting for? Join now

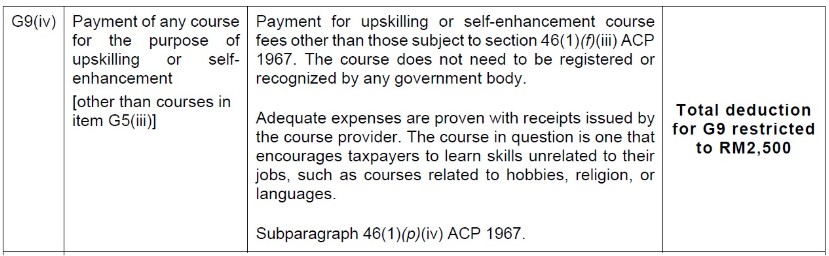

Want To Get Paid For Learning - Tax Relief

In the early years, students have asked me whether they can use this for tax relief. Good news - starting in 2024, you can deduct DYN+ Bundle as a Tax Relief of up to RM 2,500 per year.

What better way to learn - than to get paid to learn right?

So what are you waiting for?

Who Is Ka Hoe?

I started JA - the number 1 Personal Finance Academy with the intention to help executives, managers and working professionals overcome their anxiety and uncertainty during Covid-19 lockdown by elevating their financial IQ with proven money tools, systems and strategies.

JA's mission is to empower and educate 1 Million Malaysians to create healthy money habits and behaviours so they can be happy and confident with money.

Over the last 3 years, I have helped more than 7,200+ Malaysians improve their financial well-being through JA's webinars and external speaking invitations like Taylor's University, Sunway University, Crowe Howarth, Smart Investor, JCI, Money Compass, Common Ground & etc. I have also helped 21 Malaysians be Debt-Free since 2020.

Hurry! Secure your seats now

Money Problem? We Don’t Want Money To Be A Problem For You

Why am I doing what I am doing?

I believe everyone has the right to education, particularly Financial Education. Because I believe that “With Knowledge, One Can Overcome Poverty”.

But sadly we never learn Financial Education in school. I believe this is the No 1 reason why so many of us are struggling financially in Malaysia, being the No 2 highest debt-to-GDP ratio country in South East Asia.

I set out on a mission to create the 1st Debt-Free Community to help 1 Mil Malaysians overcome anxiety and uncertainties by working their money 2x harder so that they can retire 5 years earlier.

Inspired to help during MCO and Covid-19, I personally went through 3 crises in the past 14 years. So I know how it feels to go through financial difficulty.

Yes — it’s realistic as long as you’re willing to improve 3 things consistently: your cashflow habits, 2) your asset growth, and 3) your debt/owing efficiency. DYN+ is designed to work from your starting point, not from “perfect finances.” The first phase helps you see your real numbers, then we build a plan that fits your lifestyle and risk tolerance.

This is built for busy people. Most members spend: 1–2 hours/week to implement small actions 1 live session/month (or watch playback if you can’t attend live) The goal is not to “study finance for hours.” The goal is to set up a simple system along the way even on hectic weeks.

Your Financial Freedom Number is your personal finish line — the amount of wealth needed so your money can support your lifestyle (without relying on a job). In DYN+, you’ll calculate it using done-for-you templates based on: your monthly lifestyle needs your family commitments your desired retirement timeline conservative assumptions (so you don’t overestimate) So you stop guessing and start working with a clear target.

DYN+ is not “one magic investment.” It’s a financial planning process that helps you: Save first, reduce costly leaks then choose investment vehicles based on risk you can tolerate We also teach you how to evaluate “GOOD assets” so you don’t blindly follow tips, hype, or salespeople.

Market drops are normal — that’s why we don’t rely on “perfect markets.” Your plan is built on your numbers + your behavior + your system, not prediction. DYN+ helps you strengthen the foundation (cashflow + protection + strategy) so you can stay calm and consistent even when markets are up and down.

Results vary, because everyone starts differently. But if you follow the framework, your progress usually shows up in: clearer cashflow and visible savings reduced financial stress and better decisions making, stronger net worth direction (assets up, owings down) and a visible roadmap toward retirement The promise is not “instant.” The promise is a proven process you can stick with.

DYN+ is a full program to help you double your wealth within 7 years by guiding you through: a) ICE JAR (simple money management system) b) Financial Compass (your starting point: assets & liabilities) c) 1-to-1 session with a DYN Coach (personal insights + clarity) d) Financial Freedom Number (your finish line) e)Monthly Mentorship (topic-based guidance + activities + accountability) f) DYN Playbook (done-for-you templates and calculations) g) Plus your bonuses (courses + cheat sheets + consultation + e-course).

Free content gives you information. DYN+ gives you a step-by-step sequence + tools + accountability — so you actually implement. Most people don’t fail because they lack information. They fail because they don’t have a system to improve your habits and behaviors .

No. Beginners are welcome. In fact, I designed DYN+ to work with beginners and advance to build positive habits and behaviours by focusing on foundational money skills & grow strong financial roots to support your growth.

Here are all the courses that are included in your bundle.

.png)

All Courses

Start your DYN+ journey here! This module provides a clear roadmap of what to expect, how to navigate your subscription, and the key steps to maximize your results.

Free

All Courses

Gain clarity on your financial position and learn how to manage your money effectively. In this module, you’ll learn the ICE Jar system and gain clarity on your current financial situation.

RM497

All Courses, Personal Finance Series

A 60 minutes private & exclusive session - Personal Consultation with a Licensed Financial Planner & Practitioner to discuss your financial situation & how to overcome it

RM1,000

All Courses

A 3 Days Intensive Online Live Training on learning how to Double your Wealth in an Easy & Quick Manner without Making Million Dollar Mistakes. You will be able to unearth a proven formula of how Financial Planners grow their clients' wealth.

RM10,898

All Courses

Monthly Subscription of Hidden Gem System Cheat Sheet for NASDAQ and NYSE

RM2,997

.png)

All Courses

Monthly Subscription of Hidden Gem System Cheat Sheet for Bursa Malaysia + Unit Trust

RM67

Terms & Conditions

Double Your Networth (DYN) is a program by JA - Personal Finance Academy. In this Terms & Condition, JA - Personal Finance Academy also known as “Company” and Double Your Networth (DYN) also known as “Program”. The person registered in this program is also known as ‘Participant’.

All strategies in this Program are not recommendations nor advice. This Program is a proprietary syllabus developed from a collection of past experience and should not be taken as professional advice.

If you are seeking professional advice, please consult a Licensed Financial Planner. You should do your own research and/or seek expert’s advice when overcoming your current financial circumstances as every individual has a unique situation that requires in-depth understanding and solution personalization.

Participants fully indemnify the Company from all claims and liabilities arising directly or indirectly from the Program.

Participants agree and understand that results differ from person to person. The company cannot guarantee specific results from participating in Double Your Networth (DYN).

The Company cannot be responsible for the Participant’s results throughout the entirety of this Program.

The Company reserves the right to postpone the Program when it does not fulfil the Minimum Required Participants. The Company also reserve the right to determine the Minimum Required Participants.

With this, you agree with all the terms & conditions and by purchasing the ticket into this Program you are agreeable to all the specified terms & conditions above

Disclaimer: Quantum Appreciation Sdn Bhd (wholly own JA Personal Finance Academy) does not make any guarantees on your ability to get results or earn money through the use of our strategies, ideas, tools, information, etc. Furthermore, Quantum Appreciation Sdn Bhd does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its website or otherwise relating to such materials or on any sites linked to this site. Nothing on this page, any of our websites, or any of our curriculum is a promise or guarantee of results or future earnings, and we do not offer any legal, medical, tax, or other professional advice. Any financial numbers referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average earnings, exact earnings, or promises for actual or future performance. Use caution and always consult your lawyer, accountant, or professional advisor before acting on this or any information related to a lifestyle change or your business or finances. In no event shall Quantum Appreciation Sdn Bhd. be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption) arising out of the use or inability to use the materials or information in this page or any of our websites. Users are responsible and accountable for their actions. Registration to any forms on our sites is considered as the users' sole decision and does not hold Quantum Appreciation Sdn Bhd. in anyway accountable nor liable. This site is not a part of the Facebook website or Facebook Inc. It is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.